Citibank doesn’t disclose its credit history score or income necessities. Publicly stating what these specifications are may help borrowers know whether or not they stand a possibility of approval when weighing their selections.

Regardless, it is important to receive estimates from the couple of banking companies or on the internet lenders first; that way you could come to the dealership well prepared. Ask for a quote with the dealership also, comparing premiums, conditions and any further expenses.

Nevertheless, Remember the fact that should you default on your own loan, Citibank may possibly enhance the loan’s annual percentage charge (APR) by 2.0% — however This may be averted by building all of your payments on time and in complete.

Enhance your enterprise with rewards, perks and more. Review cards in one destination to discover the a person to suit your needs.

Your lending circle might have a certain purchase to the way it distributes payouts to individuals, but that may improve if you have an urgent have to have for The cash.

Auto loans Permit you to borrow The cash you need to purchase a vehicle. Given that auto loans are usually "secured", they have to have you to definitely make use of the car you might be getting as collateral to the loan.

Almost all loan buildings consist of curiosity, and that is the profit that banking institutions or lenders make on loans. Fascination rate is the percentage of a loan paid out by borrowers to lenders. For the majority of loans, fascination is compensated in addition to principal repayment. Loan interest is normally expressed in APR, or yearly proportion fee, which incorporates both of those interest and costs.

Vehicle loans guideBest auto loans once and for all and undesirable creditBest car loans refinance loansBest lease buyout loans

You can lessen your chances of needing to borrow by thoroughly monitoring your money and creating a healthy unexpected emergency fund for the longer term.

Push with assurance when you Examine insurance plan carriers and locate the plan that’s right for you.

Checkmark Spreads out expenditures. Securing a loan cuts down the sum of money you have to commit unfront for your personal automobile, as a substitute you pays across the program of the agreed loan expression.

Bankrate surveys best banks throughout U.S. markets and crunches the website quantities to seek out typical desire charges for common loan phrases. Utilize the under desk, which updates weekly, that may help you know the most effective the perfect time to buy a new or applied automobile.

Suggestion: Be sure to think about your choices not merely with Citibank but with as numerous personal loan lenders as feasible ahead of applying.

Acquiring an concept of the every month payment will help any time you’re Placing together a funds. You may perhaps discover that you've ample revenue left more than to produce more payments or simply develop a plan to get in advance within your credit card debt.

Emilio Estevez Then & Now!

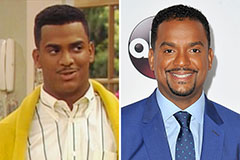

Emilio Estevez Then & Now! Alfonso Ribeiro Then & Now!

Alfonso Ribeiro Then & Now! Jenna Jameson Then & Now!

Jenna Jameson Then & Now! McKayla Maroney Then & Now!

McKayla Maroney Then & Now! Nicki Minaj Then & Now!

Nicki Minaj Then & Now!